Transferencia Hipotecaria

Mortgage Refinancing

Client:

Industry:

Industry:

0

+

Efficient Document Management

0

Secure Digital Signatures

Top #

1

Seamless Mortgage Transfers

Mortgage Refinancing

Client:

Industry:

Industry:

Efficient Document Management

Secure Digital Signatures

Seamless Mortgage Transfers

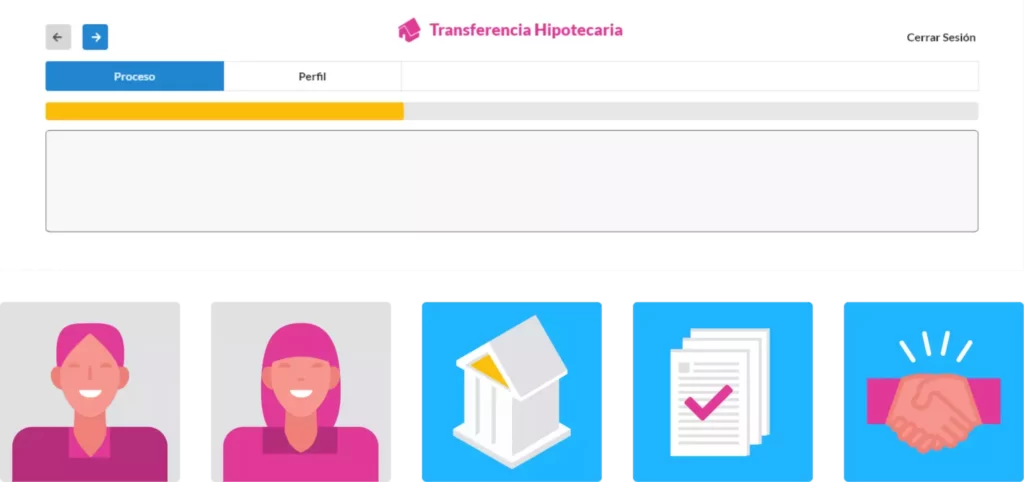

Transferencia Hipotecaria is a step-by-step system to help users search for better payment terms and financial plans regarding mortgages. To achieve this, the system designates a qualified personal assistant who evaluates under what terms the user has subscribed to a certain payment plan, then establishes a comparison with all the data made public by the financial institutions, selecting those offering more benefits at less cost. It’s built upon a constantly updated database collected from banks and financial institutions, in order to provide users with the best options that the market has to offer. With a mix of menu-driven and graphical user interfaces, detailed instructions, and a committed support team, it offers a convenient platform to complete the process end-to-end. Transferencia Hipotecaria was founded by a group of experts with many years of experience in real state and law industries, willing to lead users to a better financial situation, based on their specific needs.

Head of Innovation

Arizona State University

Head of Innovation

Arizona State University

“Webtronic Labs’ expertise and passion have proven invaluable in developing cutting-edge solutions that positively impact our community. Their genuine interest and results on our mission to enhance communication and transportation within the University Campus, making it more practical, accessible, and inclusive, was extraordinary.”

Goals

Development

We started by focusing on the company’s identity, creating a branding package that included illustrations, a new logo, and a color scheme that represented the business’s profile at best. Then, it was time to develop the system’s core, a database gathering interest rates, payment terms, and mortgage plans emitted by several banks in the region. This data would allow Transferencia Hipotecaria’s experts to decide what to suggest to their incoming users, based on their current financial situation. Simultaneously, we prepared a series of forms that would gather the necessary information to finish the process and schedule a meeting with the bank or institution that will establish a new, more convenient contract for the user.

An important part of the process was to create a validation process for the submitted documents and user information received via forms. We took a different approach in how to display long, text-heavy forms by dividing the information into several blocks grouped by type. For example, a whole block was dedicated exclusively to credit information. This allowed the user to work with the app in several sessions without losing their progress.

After several internal tests, the system was ready to be published for the first time. At first, a small amount of users were added to test the whole process and identify any problems or possible improvements. Our team gathered the initial metrics and concluded that the system was safe to be delivered. Today, our client has a fully-featured platform in which to offer their services, reaching a significantly bigger audience which now can be managed more efficiently with the administrative tools we provided. Transferencia Hipotecaria was a unique collaborative process. Our client had an active role in each phase and felt pleased to have their requests reflected in the final product. Since the first production deployment, we have continuously tested and improved the platform based on the users’ feedback.

Since the first production deployment, we continuously test and improve the platform based on a variety of user’s feedback.